Aircraft Seals Market Size Set to Reach USD 5.49 Billion by 2034, CAGR of 4.10% (2026-2034)

The global aircraft seals market was valued at USD 3.85 billion in 2025 and is projected to grow from USD 3.98 billion in 2026 to USD 5.49 billion by 2034

PUNE, INDIA, February 7, 2026 /EINPresswire.com/ -- The global aircraft seals market was valued at USD 3.85 billion in 2025 and is projected to grow from USD 3.98 billion in 2026 to USD 5.49 billion by 2034, exhibiting a CAGR of 4.10% during the forecast period. North America dominated the market with a share of 40.78% in 2025.Aircraft seals play a critical role in ensuring leak-free operation of fuel, hydraulic, pneumatic, and environmental control systems. They also provide fire protection, pressure containment, and contamination prevention across engines, auxiliary power units (APUs), landing gear, flight-control systems, and airframes. As airlines and defense operators focus on maximizing aircraft availability, improving reliability, and reducing lifecycle costs, demand for durable, long-life sealing solutions continues to rise.

Get Free Sample Report:

https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/aircraft-seals-market-114628

Top Companies in the Aircraft Seals Market

Parker Hannifin (U.S.)

Trelleborg Sealing Solutions (Germany)

Freudenberg Sealing Technologies (Germany)

Hutchinson (France)

Saint-Gobain Seals (France)

Technetics Group (U.S.)

Greene Tweed (U.S.)

Bal Seal Engineering (U.S.)

SKF (Sweden)

Kirkhill (U.S.)

Aircraft Seals Market Trends

A key trend in the aircraft seals market is the growing adoption of high-temperature polymers and advanced composite materials. Modern aircraft engines and subsystems operate under extreme thermal and pressure conditions, which require sealing solutions that maintain integrity, elasticity, and chemical resistance over long service intervals. As a result, materials such as FKM, HNBR, FFKM, PTFE, filled PTFE, and PEEK are increasingly replacing conventional elastomers and metals.

Another major trend is the rising preference for spring-energized PTFE seals, which provide consistent sealing force, low friction, and excellent wear resistance. These seals are widely used in dynamic applications such as actuators, pumps, and rotating shafts, where performance stability is critical.

Sustainability considerations are also influencing material selection. The growing use of sustainable aviation fuels (SAF) is changing chemical exposure profiles inside engines and fuel systems, prompting seal manufacturers to qualify materials with improved compatibility and chemical resistance. Additionally, digital inventory management, modular seal kits, and regional finishing centers are being adopted to shorten lead times and support faster MRO turnaround.

Aircraft Seals Market Growth Factors

One of the primary growth drivers is the expanding aging aircraft fleet worldwide. As aircraft age, seals experience degradation due to thermal cycling, chemical exposure, vibration, and mechanical wear. This results in higher replacement rates during scheduled maintenance checks and unscheduled repairs, driving steady aftermarket demand.

The strong recovery in commercial air travel and continued growth of low-cost carriers are also supporting higher aircraft utilization rates, particularly for narrow-body aircraft. Higher flight cycles translate directly into increased wear of dynamic seals in hydraulics, flight-control actuators, and landing gear systems.

Additionally, aircraft OEMs and operators are increasingly upgrading sealing systems with advanced materials to extend service life, reduce leakage, and improve reliability. Such upgrades often involve premium-priced materials, which raise the overall value of the seals market.

On the defense side, rising investments in military aircraft modernization and fleet readiness programs are contributing to stable demand for high-performance sealing solutions across engines, fuel systems, and environmental control systems.

Aircraft Seals Market Segmentation Analysis

The aircraft seals market is segmented by seal type, material, platform, and application. Dynamic seals held the larger share in 2025 due to extensive use in moving components and higher replacement rates, while static seals are expected to grow steadily, supported by door, window, nacelle, and barrier sealing demand.

Within static seals, D-section seals led the market in 2025 owing to long sealing lengths and regular refurbishment, whereas O-rings and X/quad-rings are projected to grow fastest due to wide subsystem usage. For dynamic seals, rod/piston seals and wipers dominated, with carbon and spring-energized PTFE seals gaining traction in high-temperature and high-speed applications.

By material, polymers accounted for the largest share, followed by growing adoption of composite seals, while metal seals remain niche. Fluoroelastomers (FKM/FPM) led polymer usage in 2025, with HNBR and FFKM expected to grow faster. Narrow-body aircraft dominated by platform, while wide-body aircraft are set to grow at a higher pace. By application, hydraulics and flight actuation led the market, with strong growth also expected in landing gear and engines & APU.

Speak to Analyst:

https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/aircraft-seals-market-114628

Regional Insights

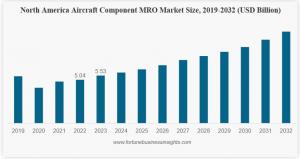

North America led the aircraft seals market in 2025 with a value of USD 1.57 billion, supported by strong aircraft production, a large installed fleet, and a mature MRO ecosystem. The U.S. accounts for the majority of regional demand due to its large commercial aviation market and significant defense spending.

Europe represents the second-largest market, driven by strong aerospace manufacturing activity and a well-established MRO network. Countries such as the U.K., Germany, and France contribute significantly to regional demand.

Asia Pacific is expected to register the fastest growth during the forecast period, with a CAGR of 4.84%. Rapid expansion of commercial fleets, rising domestic aircraft production, and growing MRO capacity in China, India, and Japan are major growth drivers.

The Middle East & Africa and Latin America are projected to witness moderate growth, supported by fleet expansion among regional carriers and increasing investment in aviation infrastructure.

Key Industry Developments

May 2024: Trelleborg announced investment in a new aerospace sealing production facility in Morocco.

May 2025: Hutchinson’s O-ring production facility in France achieved AeroExcellence Bronze certification.

July 2025: Greene Tweed published test results confirming fluorine-based elastomer seal compatibility with sustainable aviation fuels.

November 2025: Freudenberg-NOK Alto Products Corp. was acquired by Sealing Technologies and Corteco to strengthen aftermarket capabilities.

June 2025: Omniseal Solutions launched enhanced spring-energized polymer sealing systems for high-performance aerospace applications.

Related Reports

Aircraft Engine Market Size, 2034

Aerospace Composites Market Share, 2034

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.